It has continued to slide even as President Trump has backed down from his tariff threats and the U.S. stock market has recovered from its losses.

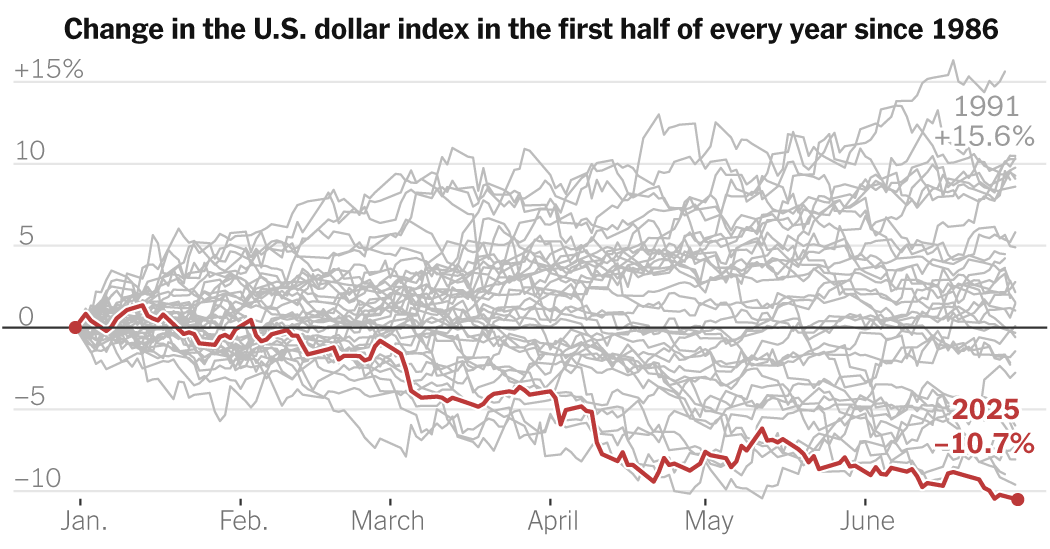

The dollar is off to its worst start to a year in more than half a century.

The United States’ currency has weakened more than 10 percent over the past six months when compared with a basket of currencies from the country’s major trading partners. The last time the dollar weakened so much at the start of the year was 1973, when the United States made a seismic shift and ended the linking of the dollar to the price of gold.

Percentage change in the U.S. dollar index in the first half of every year since 1986.

This time the seismic event is President Trump’s efforts to remake the world order with an aggressive tariff push and a more isolationist foreign policy.

The combination of Mr. Trump’s trade proposals, inflation worries and rising government debt has weighed on the dollar, which has also been buffeted by slowly sliding confidence in the role of the United States at the center of the global financial system.

That means it is more expensive for Americans to travel abroad and less attractive for foreigners to invest in the United States, sapping demand when the government is trying to borrow more money. On the flip side, the weaker dollar should help U.S. exporters and make imports more expensive, though these typical trade effects are in flux because of the tariff threats.

Even as Mr. Trump has backed down from his most of extreme tariffs and the U.S. stock and bond markets have recovered from their losses earlier in the year, the dollar has continued to slide.